Connected Retailing Solutions for Consumer Duty Compliance

Meeting Consumer Duty Responsibilities

How the right technology can help you deliver good outcomes for consumers

With the Financial Conduct Authority's (FCA) new Consumer Duty regulations coming into force in July 2023, financial services firms in the automotive industry are facing increased scrutiny over how they treat their customers.

Consumer Duty introduces new rules for dealers and lenders to follow aimed at delivering good outcomes for retail customers. In this post, we will look at the Consumer Principle, the new Cross-Cutting Rules, the Four Outcomes, Key Milestones, and how iVendi's solutions can help.

What is Consumer Duty?

The FCA's Consumer Duty is a new set of rules created to improve how financial services firms treat their customers. The new Duty "sets higher and clearer standards of consumer protection across financial services, and requires firms to put their customers’ needs first." All financial service providers that are regulated by the FCA and offer products or services to consumers must follow these rules.

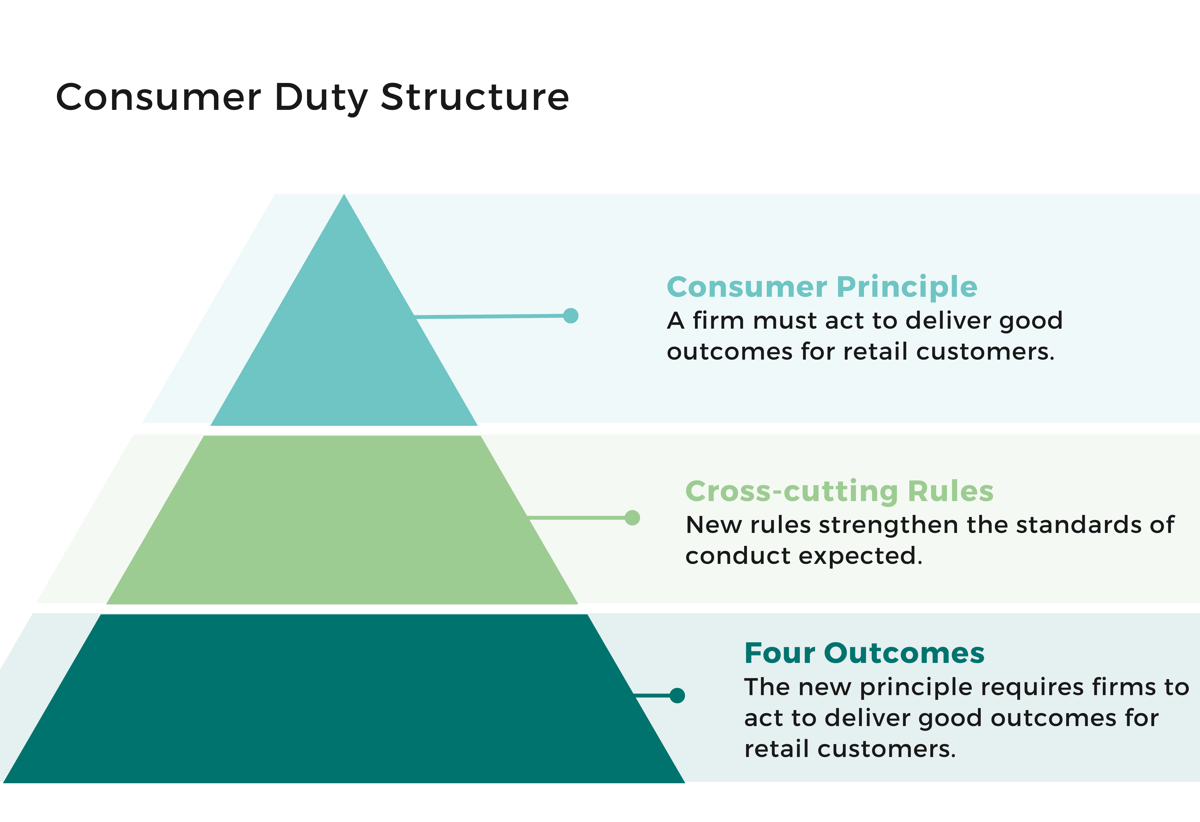

The FCA expects the Duty to be reflected in the strategies, governance, leadership and people policies of all regulated firms. In the motor retail space, this applies to car dealers and finance providers and can be distilled down to three main areas: The Consumer Principle, Cross-Cutting Rules, and Four Outcomes.

-

27 July 2022: Final rules and guidance published

-

31 October 2022: Firms agree implementation plans

-

30 April 2023: Manufacturers complete reviews to meet the outcome rules

-

31 July 2023: Rules start for open products/services

-

31 July 2024: Implementation deadline - Rules start for closed products/services

The new Consumer Principle sets a higher standard than the previous standard of 'treating customers fairly'. The overarching principle requires firms to take responsibility for serving consumers' interests and delivering good outcomes for customers. Consumers will remain responsible for the decisions they make, but firms must use more judgement when considering the impact of their actions on outcomes for consumers.

The Consumer Principle is designed to lead to a "major shift in financial services", by placing the emphasis on outcomes. Financial services firms will be required to comply with the new rules from 31 July 2023.

The FCA has prepared guidance on how to prepare an implementation plan with advice on what you need to do and when during the implementation period.

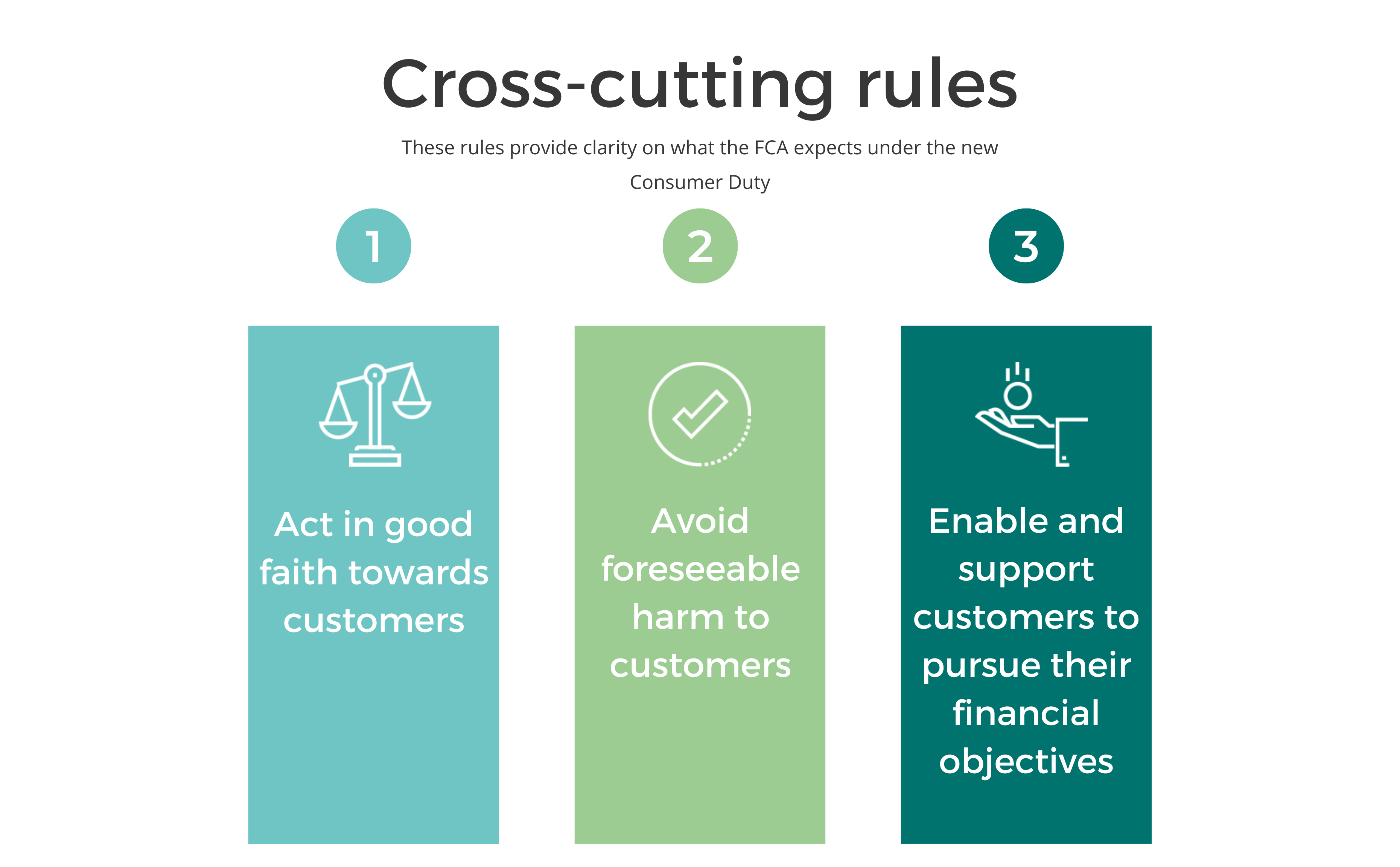

The delivery of a "good outcome" doesn't have an established legal meaning. To provide clarity and to help firms interpret the new principle, the FCA has defined three overarching and cross-cutting rules.

The rules require firms to: act in good faith, avoid causing foreseeable harm, enable customers to pursue their financial objectives.

Full details of the new cross-cutting rules is available from the FCA.

Act in good faith

Financial services firms must act in good faith towards retail customers. This means acting honestly, fairly and consistently and acting with reasonable expectations of consumers. Acting in good faith, firms should take into account the consumer's interests and their circumstances and work to delivery good outcomes for customers. This does not mean a firm is prevented from pursuing legitimate commercial interests or seeking a profit, provided it does so in a matter that is compliant with the Consumer Principle and the Cross-cutting Rules.

Avoid causing foreseeable harm

Financial services firms must avoid causing foreseeable harm to retail customers. This includes ensuring that no aspect of its business involves unfairly exploiting vulnerabilities, and identifying the potential harm that might arise if it changes or withdraws a product.

Firms are expected to take appropriate action to mitigate the risk of actual or foreseeable harm including ensuring that retail customers do not face unreasonable barriers and allowing time and support for retail customers to find suitable alternatives where a product is withdrawn.

Enable customers to pursue their financial objectives

Financial services firms must enable and support retail customers to pursue their financial objectives. Enabling and supporting retail customers to pursue their financial objectives includes acting to empower consumers to make good choices including by making sure they have the information and support they need to make informed decisions, and taking into account any biases or vulnerabilities in all aspects of the customer journey.

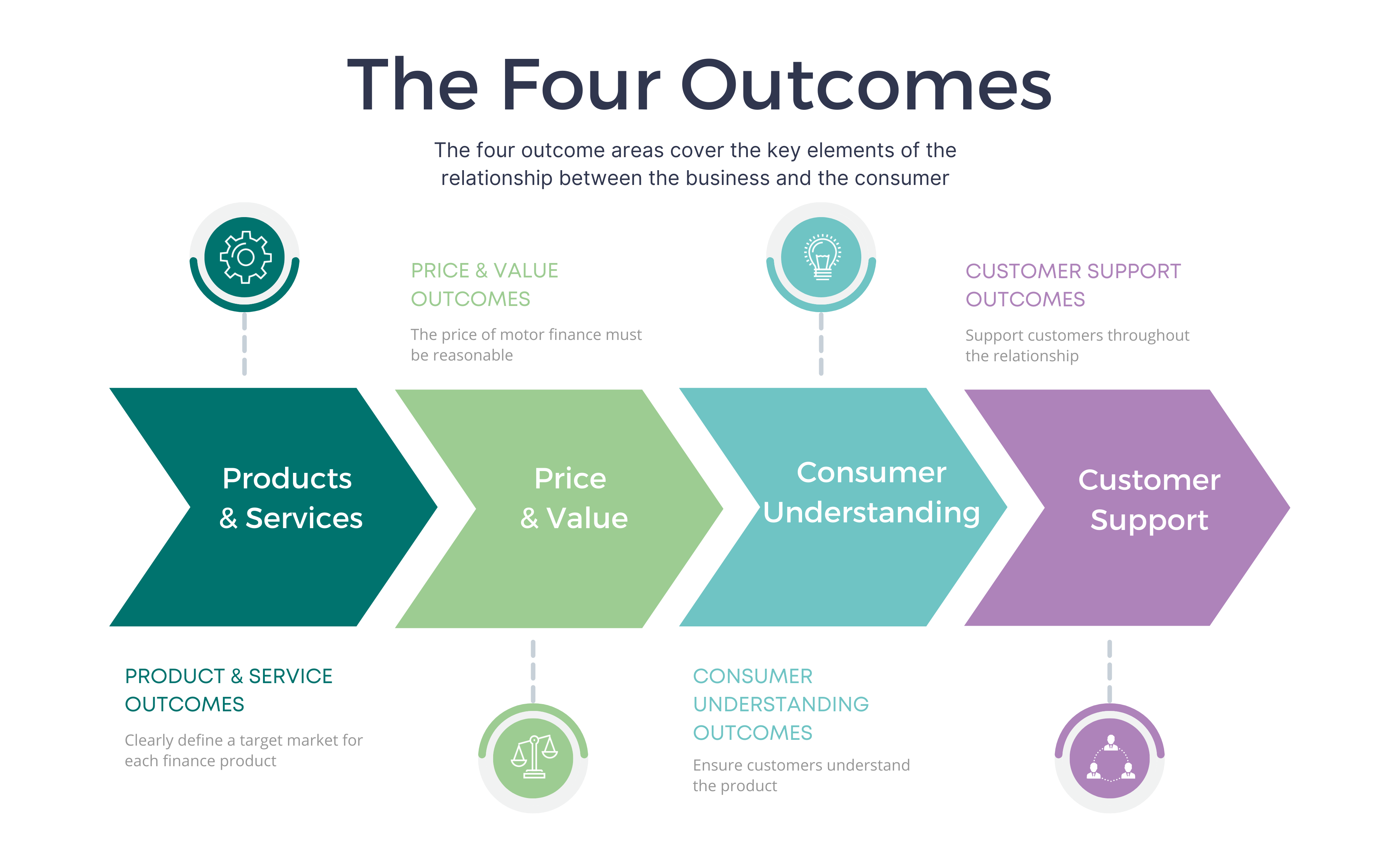

The new Consumer Duty is underpinned by four outcome areas covering the key elements of the relationship between financial services firms and their customers. These outcomes define the expectations of firms under the new regulations.

The four outcome areas include: products and services, price and value, consumer understanding and customer support.

It is important that firms understand the implications of each outcome and devise actionable steps toward delivering these. The FCA has put together guidance on how to prepare for the implementation deadline, including details of the four outcomes.

1. Products and services outcomes

Financial services firms must clearly define a target market for each motor finance product and assess why it is suitable for consumers. Especially, vulnerable customers who might choose the product must be identified. All of this needs to be established and evidenced through MI while regular reviews should be used to measure outcomes for consumers and drive future improvements.

2. Price and value outcomes

This is all about ensuring that the customer gets fair value. Essentially, there is an expectation for firms to ensure the price of motor finance is reasonable. Lenders should undertake and provide a value assessment, and this must be done on a routine basis.

3. Consumer understanding outcomes

Communications must be created for consumers that allow them to make informed and effective decisions prior to the point of sale.

The key point here is to ensure that customers, especially those that are vulnerable, understand the product, avoiding consumer harm. This must be tested on a regular basis with improvements made where necessary.

4. Customer support outcomes

The principle here is to support customers throughout the product lifecycle and for the lifetime of the relationship to ensure they are in no way disadvantaged. There should be regular reviews of organisational services such as call monitoring and complaints using MI to make sure that these objectives are being met.

The new Consumer Duty is a significant development in the financial industry and it is expected to have significant implications for firms. When we first heard about the potential of a new Consumer Duty being discussed in 2021, we recognised a real opportunity to support the market and meet the evolving demands of consumers. Our Connected Retailing Platform helps motor retailers and lenders meet their Consumer Duty responsibilities in a number of ways.

Product Enhancements

To to help motor finance providers in fulfilling their responsibilities under the new Consumer Duty, we’ve upgraded our customer journey to include a series of enhancements aimed at helping lenders and dealers meet the new requirements and fulfil the four outcome areas.

Lender Specific Data: The application process now includes a bespoke page listing all the relevant information on the specific finance product chosen by the consumer. Product information is provided by the lender, helping to ensure the product is being introduced in the right way.

Lender Product Videos: This feature allows lenders to supply product information videos explaining the differences and benefits of each finance product, making certain that the product is being introduced properly.

Suitability Assessments: To establish that the customer understands the product, we've included a series of questions, specific to that finance product and provided by the lender, which the customer must answer before proceeding to the application. If the customer does not understand the product, they would be referred to the retailer to offer support in finding a suitable product for their needs.

Support Signposting: We've introduced signposting to government financial advice as well as the lender's own support resources at key points i the journey to assist the consumer, particularly vulnerable customers, in making an informed decision.

Reduce Rejections: Lenders have very specific rules about when, how and to whom they will offer finance. Where we know the specific rules of a lender(for example, lenders who won't lend to taxi drivers), we will intercept this application in the dealer platform before it is sent to the lender, This allows the retailer to support the consumer with finding a lender that better meets their needs and avoids a rejection - a bad outcome for the consumer the retailer and the lender.

Consumer Self-Serve

In recent years, there has been a growing emphasis on consumer protection in the financial services industry. The introduction of new regulations such as Consumer Duty has placed greater responsibilities on firms to act in the best interests of their customers. One area where this is particularly important is in motor finance, where customers may not fully understand the products and services they are offered.

In recent years, there has been a growing emphasis on consumer protection in the financial services industry. The introduction of new regulations such as Consumer Duty has placed greater responsibilities on firms to act in the best interests of their customers. One area where this is particularly important is in motor finance, where customers may not fully understand the products and services they are offered.

The regulations require firms to take a more proactive approach to consumer protection, by putting the customer at the heart of their business and ensuring that products and services throughout the customer journey are designed to meet consumer needs. The goal of these new regulations is to make financing a new car as transparent as possible for consumers.

By allowing customers to self-serve, firms can ensure that they are meeting these requirements, as customers are able to make their own choices about the products and services they want. This can also help build trust between businesses and their customers, as customers are more likely to feel that they have been treated fairly and with respect and helps to reduce the risk of mis-selling.

Mis-selling is a serious issue in the financial services industry and can occur when customers are sold products that are not suitable for their needs. Allowing customers to self-serve, dealers can ensure they are not pressuring customers into buying products that they do not need, and that customers are making choices based on their own needs and circumstances, protecting customers from financial harm.

Customer self-service is becoming increasingly popular in the motor finance industry as it allows customers to have greater control over their accounts and transactions, as well as provides a more convenient and faster service. The consumer self-serve solution provided within iVendi’s Connected Retailing Platform provides customers with a suite of tools delivering choice, visibility and transparency, allowing customers to make informed financial decisions with confidence. The solution offers product suitability assessments, informative product videos, the ability to compare multiple finance products and finance lenders, and an audit trail of transactional activity.

These tools give dealers confidence that consumers are fully informed about the products they are purchasing and can make effective decisions that are in their best interests. By embracing customer self-service, dealers can demonstrate their commitment to increasing consumer and reducing consumer harms protection and ensure that they are meeting their regulatory obligations.

Management Information

Under the new Consumer Duty, financial services firms will need to assess and evidence how they are acting to deliver good outcomes for consumers throughout the lifecycle of the products and services they provide to them. Firms will need to ensure their data strategies will be able to identify, monitor, evidence and stand behind the outcomes their customers experience.

Under the new Consumer Duty, financial services firms will need to assess and evidence how they are acting to deliver good outcomes for consumers throughout the lifecycle of the products and services they provide to them. Firms will need to ensure their data strategies will be able to identify, monitor, evidence and stand behind the outcomes their customers experience.

Rob Severs, Senior VP Product and Insight at iVendi, emphasised the importance of monitoring essential metrics over the longer term to prove that customer needs were being put first.

“As the new Consumer Duty rolls out, much more responsibility is going to be placed on retailers to track consumer activity along every step of the finance journey”, says Severs.

"Management Information (MI) will play a crucial role in helping both lenders and retailers prove compliance and continuous improvement in Consumer Duty. It provides the data and insights necessary for senior managers to understand how good vehicle buyer outcomes are being delivered and where improvements need to be made.”

MI provides businesses with a clear understanding of how their customers interact with their products and services. This data can help senior managers identify areas where they need to improve customer outcomes, identify trends, and ensure that their products and services meet consumer needs.

To meet the Consumer Duty regulation requirements, firms need to have accurate and up-to-date MI that should include data on customers interactions, customer journeys, customer complaints, and customer satisfaction levels. Businesses should also use this data to assess the effectiveness of their processes, procedures and products.

Most retailers who are operating with a multi-lender panel, are very likely to be submitting applications and checks individually to those lenders. Relying on separate processes and systems leaves too much room for error - something the FCA want to avoid when it comes to consumers' private information - and easy to do when running the same information through multiple systems.

Through our Connected Retailing Platform, dealers can compile, track and report on MI. The platform also provides dealers with additional data such as audit trails that capture and demonstrate compliant selling across a panel of lenders, data on market finance rates to ensure dealer offerings remain competitive, and sufficient insight across all their lenders partners to produce accurate representative examples.

Not Sure Where to Start?

Our new Consumer Duty Ultimate Bundle is the perfect product mix created to support dealers in meeting their requirements under the new FCA regulations, designed to satisfy the four outcome areas while aligning sales journeys with the three cross-cutting rules.

Dealers can easily upgrade their existing technology stack to the new package, which includes all the features they need - finance calculators, online and showroom finance checking, multi-lender quoting and submission, vehicle reservations, FCA and commission disclosure status, lender-specific product information, lender product videos, product suitability assessments, support services signposting for vulnerable customers, customer credit rating, stock engine, customer self-serve tools, online finance applications, iVendi’s Digital Deal, application interceptions and comprehensive management information.

Learn more about our Consumer Duty Product Bundles

Learn more about how iVendi's Connected Retailing Platform can help strengthen your compliance strategy.

More from iVendi

Security & Compliance

At iVendi, we take information security and compliance seriously. Visit the iVendi Trust Centre to learn more.

Industry Insights

Visit our Industry Insights page hosting a library of resources aimed at helping motor dealers and lenders maximise their business potential.

Digital Transformation

Get to know the role technology plays in helping you future-proof your business, meet your regulatory regulations, and increase your profitability.