What is Finance Navigator?

Finance Navigator is a smart finance decisioning tool that connects your customers to the right lender - first time, every time. It instantly matches buyers to suitable lenders, returns personalised rates in real time, reduces declines, and saves valuable time during the sales process.

Feature |

What it Does |

Why it Matters |

| Direct Lender Decisions | Uses lender APIs or rules to deliver decisions straight from the source | Cuts out guesswork - faster, more accurate outcomes for you and your customers |

| Real-Time Accuracy | Pulls live data to show what’s truly available, not just what might be possible | Saves time, avoids declines, and keeps your deals moving |

| Soft Search & Pre-Approval | Runs soft searches and flags pre-approved options before any credit hit | Builds customer trust with no credit score impact during early steps |

| Personalised SPRs | Shows tailored rates from lenders up front, before any hard search | Gives buyers transparency and control - no surprises at the end |

| Lender-Led Design | Developed in partnership with lenders, adapting to their changing risk appetite | Keeps you ahead of the curve as lender criteria shift |

| Direct-to-Lender Model | Connects you straight to the lender, not through a middle layer | Better commissions, clearer compliance, and quicker decisions |

| Lower Compliance Risk | Defines your FCA role alongside the lender’s expectations | Helps protect your business by reducing regulatory risk |

| Promote Lender USPs | Surfaces unique value-adds from individual lenders (e.g. payment holidays, flexibility) | Helps customers weigh up both price and added value - improving confidence and conversion |

What Finance Navigator Delivers

Smarter Matching

Dynamic pricing and real-time decisioning ensures each customer sees the best offer available - based on actual lender rules, not guesswork.

Higher Approvals, Less Rework

No more submitting deals that won’t stick. Finance Navigator surfaces eligible lenders up front, reducing declines and wasted effort.

Better Customer Experience

Your customers get personalised, accurate finance quotes before a hard search. That means more transparency, more trust, and more conversions.

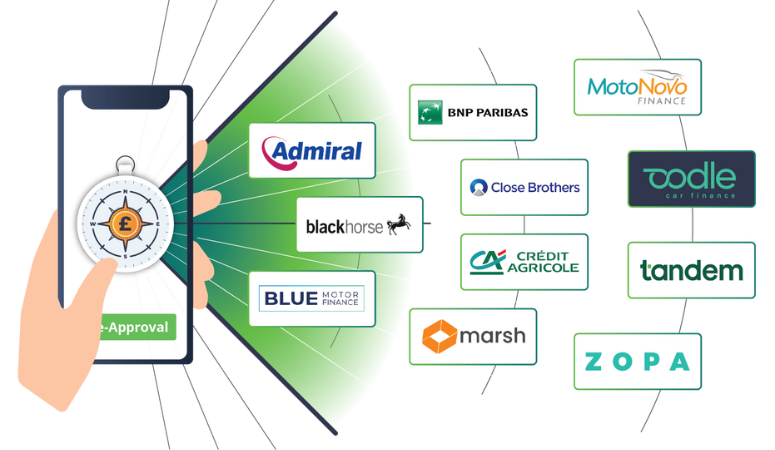

Works With Your Lender Panel

Fully integrated with our multi-lender platform, Finance Navigator lets you offer direct-from-lender finance with all the flexibility and control your dealership needs.

Smarter Finance, Seamless Experience

No new logins. No new systems. Finance Navigator works as part of your existing iVendi setup - at no extra cost*

Why it Matters

Half your customers risk rejection. Finance Navigator changes the odds.

When only one lender is considered, up to half of your customers risk rejection - leading to lost sales, rework, and frustrated buyers. Finance Navigator flips the script. By evaluating multiple lenders upfront and returning real-time, personalised rates, it helps you close more deals, faster. Whether you want to:

Save time in the showroom

Improve finance conversion rates

Protect consumer credit profiles

Reduce rekeying and operational drag

Finance Navigator is built for your dealership. Be the first to hear when it goes live. Register your interest for early access to Finance Navigator.

Make Rejection the Exception

Fewer Declines = More Sales: Real-time eligibility checks mean fewer rejections and more deals that stick.

Higher Finance Penetration: Tailored offers turn more browsers into buyers — with early adopters seeing measurable uplifts in commission.

Credit-Safe Journeys: Soft searches protect your customers’ credit profiles, even if they don’t proceed.

ROLLING OUT FROM 28TH JULY

Be First to Navigate Smarter Finance

We’re getting ready to launch Finance Navigator - our latest innovation to simplify finance, reduce declines, and drive better outcomes for your customers.

Setup is seamless: Finance Navigator is included as part of your existing service. No new systems, no extra logins, and no added cost*. Just smarter decisions, delivered through your existing iVendi platform.

Unlock full access at no extra cost.

Expand Your Lender Panel*: Offer More Financing Options. Submit a request to add more lenders to your panel.

*Subject to lender approval

*Subject to lender panel.