Gone are the days of going to the bank to speak to a bank manager to secure finances for big-ticket purchases. Consumers can now do almost everything from the comfort of their own homes.

For many, going directly to the finance provider or retailer is the default option, and many do so without needing to speak to a salesperson or account manager.

However, as the cost of living crisis continues and personal finances are squeezed even further, motor retailers need to make consumers who are still in-market for a new vehicle feel at ease about their next financial decision.

In this post, we’ll look at what matters most to finance consumers in 2022 and offer some tips to help make the process as easy as possible.

What do consumers think, and why does it matter?

The big decisions that we all make, the ones which rely on finance like mortgages and cars, we make so infrequently that as a consumer, it’s near impossible to become fully versed in all the intricacies of a finance agreement – which can sometimes lead to buyers regret.

As a result, it may be difficult for consumers to change their minds, if they weren’t made aware of all the details of their finance purchase - something the FCA has recently set out to change.

A major benefit of finance in the modern day is that it’s a 24-hour business. Finance eligibility checking online allows consumers to browse their options at any time day or night, and in most cases they can even apply for finance at a moment's notice.

Another benefit is the privacy it provides. Yes, as a consumer I’m inputting my personal details into your finance system, but no one will see if my eligibility checks fail, and I can run as many as I’d like provided they’re not impacting my credit score.

We’ve all been there, even when it’s a simple transaction in a supermarket, the card machine doesn’t work and your heart sinks, you panic immediately thinking you could be short of funds.

Now, imagine that feeling multiplied tenfold, and it’s for something as important as a car!

In addition to the customer's feelings towards engaging with the finance journey, there’s also the additional factor of stricter finance criteria laid out by finance providers, making the barrier for entry even higher.

This is why we believe retailers need to be paying special attention during the cost of living crisis – can your potential customers check their eligibility for the financial products you offer, and maintain their privacy while also avoiding awkward situations they may not be prepared for?

How to make the experience work for consumers?

We believe it’s not too difficult to give consumers a more comfortable finance experience.

There’s a host of online finance eligibility tools on the market, many specific to automotive finance, that let consumers check their likelihood of approval ahead of any in-person interaction.

Our CCO, Darren Sinclair, recently spoke about the cost of living crisis, and what it means to retailers and consumers.

“The cost of living crisis and the high likelihood of recession means that motor finance providers will almost certainly tighten the criteria on which they base their lending in order to minimise the risks they face.

“Almost inevitably, this will mean that fewer people meet the requirements of their preferred lender and may end up turning to their second, third or fourth choice, or even deciding not to buy at all.”

Taking some of these processes out of the showroom not only makes them more appealing to consumers, it also cuts the time your salespeople spend re-inputting potential buyer information to find a finance match.

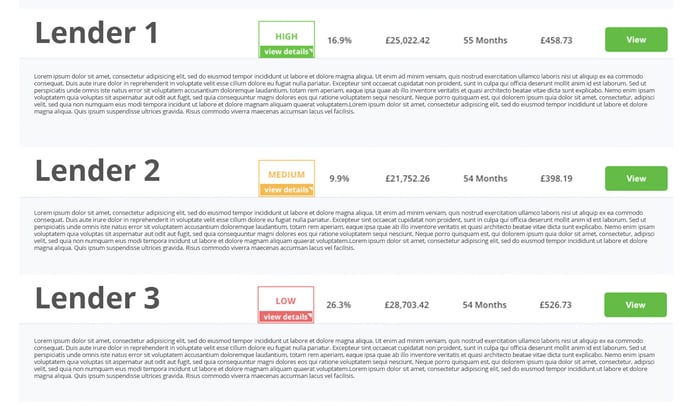

Darren continued: “The advantage of online eligibility checkers is that they allow potential buyers to look at a dealer’s lending panel for a variety of motor finance products. They can see instantly and at a glance their likelihood of approval using a traffic light system – all without leaving a footprint on their credit file. It’s a much softer and friendlier process than making a formal application.

“During the kind of tough period for personal finances that we are experiencing, one which is likely to get worse, this kind of visibility is not just important but perhaps essential to consumers who are likely to be very aware of their current circumstances.”

Tips for making consumers comfortable with finance.

It’s likely you’re already familiar with how consumers are interacting with your finance products, however, we’ve compiled a short list of our top 3 tips to make sure your finance journey is as consumer-centric as possible.

1. Put Privacy First - Given the current financial climate, in-market vehicle buyers may want to keep their finances close to their chest. Completing a finance eligibility check or application from your own home eliminates the worry about privacy, as the consumer interacts directly with the lender's systems.

2. Multi-Lender - If an application does fail, how easy is it to find one that won’t? Can consumers apply to multiple finance lenders from your website? -If your focus is on increasing finance penetration, having a multi-lender panel available will increase the finance acceptance rate.

3. Impact-Free Credit Checks - If an eligibility check does fail, but you have a more affordable vehicle on offer, can the consumer check their eligibility again without having to worry about the lasting impact repeated checks can have on their credit score? Provide an impact-free option, making sure consumers can easily see the risk-free checks.

I want to change my finance journeys, but don't know where to start.

Darren said that many dealers with which iVendi worked incorporated the company’s eligibility checking tool into their normal customer journey.

“Eligibility checking works well when it is built into an online buying process, being offered as a no-cost option to customers who would like to buy a car and want to gain a full understanding of the motor finance options to them.

“It’s a question of working to understand how the cost of living crisis is likely to affect the customer mindset. Buyers will almost certainly realise that their chances of approval from their preferred lender are lower and will want a greater understanding of the situation.

“At a time when people are feeling less confident about their finances, there is a strong likelihood they will find a high degree of comfort in having greater amounts of quality information available to them online. Eligibility checker technology makes this possible without them needing to speak to a person or face the embarrassment of potential finance application rejections.”

Learn more about the way consumers interact with finance!

You can learn more about the way consumers want to interact with finance in our latest white paper, Better Buying Journeys, where you can compare your current processes against our checklists and see where you can make improvements to your sales channels.