More and more motor finance providers are thinking about the possibility of creating their own digital car sales marketplaces because of two key advantages they deliver.

1: That lenders create a new channel through which to capture an increased amount of business. As they know, the needle only has to be nudged a relatively small amount in terms of market share to access substantially higher profits and a new marketplace can deliver an excellent return on investment.

2: That it allows dealers to sidestep at least some of the substantial expenditure they make when advertising cars online, which is a cost that tends to grow from year to year. Providing a free or low-cost alternative is a definite advantage for retail partners.

Having decided to go down this path, motor finance companies face a fundamental question. Should they buy or build the platform they need? This is a question to which the answer is not necessarily straightforward.

We’ve found, when working with lenders in this area, that there is often a natural tendency at first to want to control as much of the process of creating the technology needed as possible. However, it is generally soon discovered that internal resources are limited in terms of both capacity and specific expertise. We have seen businesses spend years on development with only unsatisfactory results to show for their efforts.

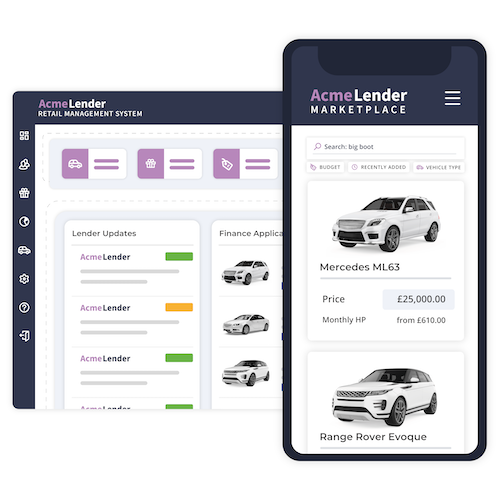

The most successful endeavours tend to blend both options. When it comes to the core functions of the digital marketplace, high quality solutions are available effectively off-the-shelf from third party providers such as ourselves. It becomes very much a question of why you would reinvent the wheel? On one hand, these are well-priced, proven products that can be easily adapted to your specific requirements. On the other, advanced features such as our recently introduced stock module take years of development time. There is almost no advantage in terms of cost or function in creating your own platform.

Some motor finance providers believe that USPs can be created through using their own technology but our experience is that differentiation is instead delivered through their approach to the market and the application of the products adopted. Simply having a marketplace is, of course, a key differentiator in itself.

The development capacity of the motor finance provider is instead best concentrated in areas such as APIs for settlement requests, detailed product information, rate setting for individual dealers and more. It is here that their in-house expertise can make the biggest difference to the performance of the platform – for themselves, for retailers and for end users.

Using this blended approach, we have found that highly effective marketplaces can be operating in a matter of months with expenditure kept to a minimum. It’s not a question of building or buying the technology needed - but applying the right solution to the right parts of the project.